Publications and disclosures

As an electricity distributor, Top Energy is required to provide important information

Find out more

Hēnā, tirohia te hekenga utu i tō pire hiko ā te marama o Mei

Who gets the discount?

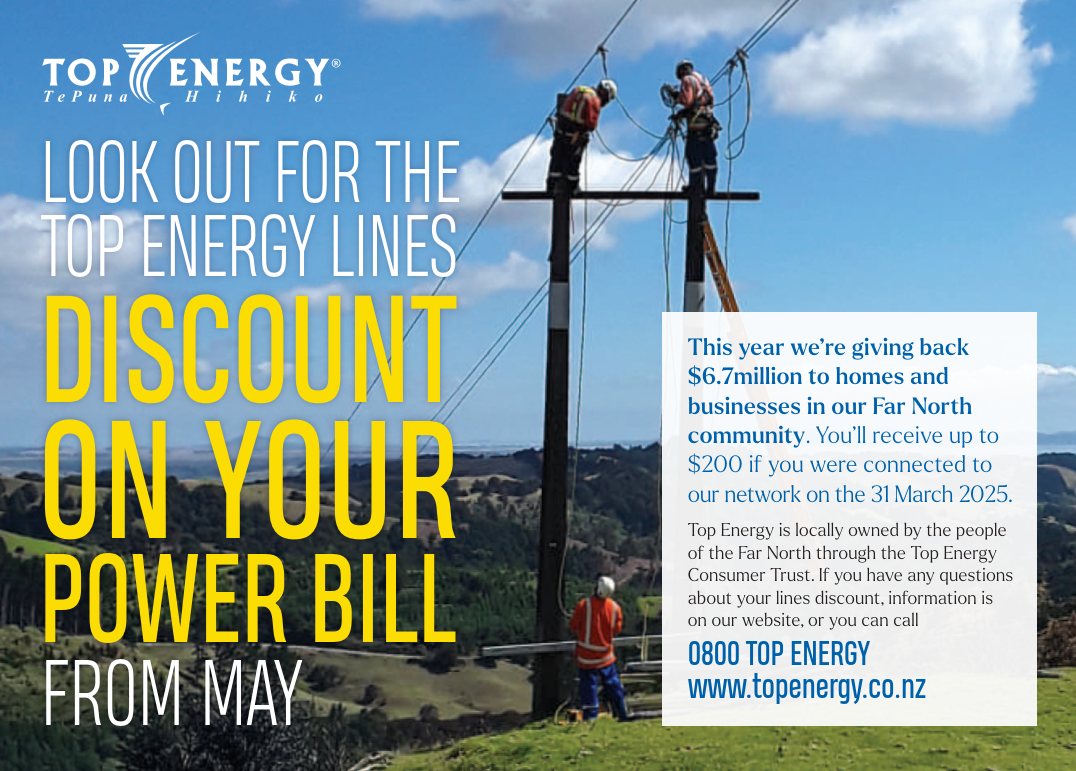

You are eligible for the Top Energy discount if you were connected to the Top Energy network, your name is on the bill on 31 March 2025, and you used more than 1 kilowatt hour (kWh) of power between 01 April 2024 and 31 March 2025.

To receive the full $200, you must have used over 1,130 kWh. If you have used between 1 and 1,130 kWh, you will receive a minimum of $57 if on a Low User Residential Plan or $143 if on a Standard User Residential Plan or General Commercial Plan, and the total dollar amount will increase depending on your kWh power consumption.

If you were not connected on 31 March 2025, you won’t be eligible for the discount.

When will I see it on my bill?

For most customers this will appear on your May bill. If it doesn’t appear as a discount line on your bill by June, please check with your electricity retailer.

How is it applied to my bill?

If you:

Why don’t Top Energy reduce the lines charge?

We don’t reduce the lines portion of your bill, as your electricity retailer has no obligation to pass on line cost reductions. However, the benefit of a discount must be passed through.

If I close my account and the discount doesn’t appear, who do I take this up with?

If you were connected to the Top Energy network on 31 March 2025, you should contact the electricity retailer with which you had an account on that date.

My neighbour has received two discount payments, and I’ve just received one. Why?

It must be that your neighbour has more than one electricity account and connection point.

Does each power connection receive a separate line charge credit?

Yes.

Will I have to pay income tax on my discount payment?

Only if you claim your electricity payments as a business expense in your tax return.

Does the discount include GST?

Yes. $173.91 + GST of $26.09 = $200

Why has my payment fallen from $300 incl. GST to $200 incl. GST?

The previous payment consisted of a $200 discount, including GST, and a $100 dividend. This year, the payment only consists of the discount, which has remained unchanged.

When will I be paid out a dividend then?

If the Top Energy Consumer Trust provides a distribution, you will be notified by the Trust later this year. This would be paid out separately from the discount.

I am in credit with my power account - how do I get the cash?

You should call your electricity retailer, and they may arrange a payment or offset against future bills.

My name is no longer on the electricity bill. But it was until very recently.

Discounts are paid through electricity accounts, and it is the account holder on 31 March who gets the discount.

I’ve left the region, but I paid power bills for most of this year.

Discounts are paid through electricity accounts, and it is the account holder on 31 March who gets the discount. You may qualify for a lines charge discount from the lines company in your new region.

I am not happy with the process. Who can I take this further with, and how?

Contact Top Energy on 0800 867 363 or email feedback@topenergy.co.nz

As an electricity distributor, Top Energy is required to provide important information

Find out more